|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

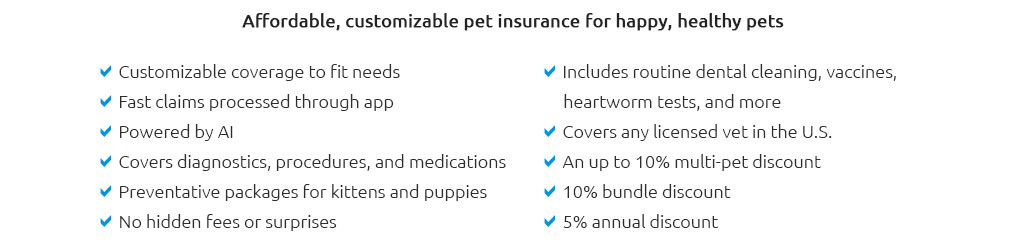

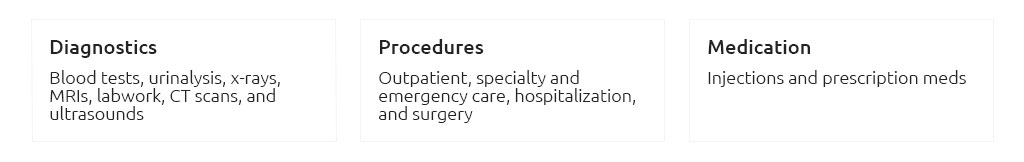

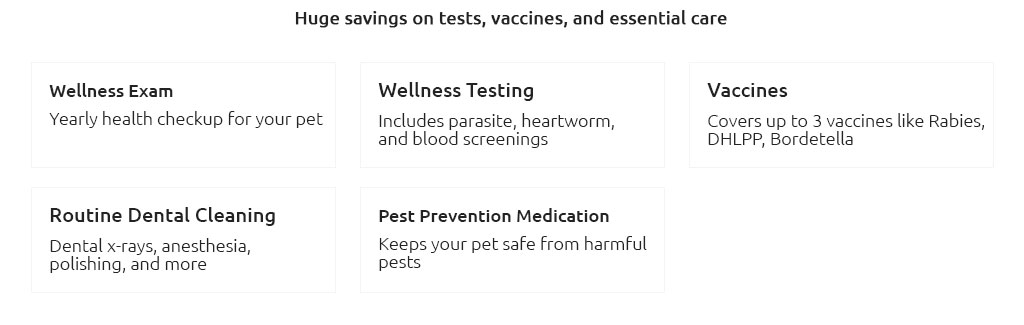

Exploring Pet Insurance Wellness Plans: Frequently Asked QuestionsIn recent years, the landscape of pet care has evolved dramatically, not only in terms of medical advancements but also in the realm of pet insurance. Among the myriad of options available to pet owners, wellness plans have emerged as a particularly intriguing choice. These plans, often nestled within broader pet insurance packages, are designed to cover routine care and preventative treatments, which are crucial for maintaining the overall health of our furry companions. But what exactly is a pet insurance wellness plan, and is it a wise investment? Firstly, it is important to understand what a wellness plan entails. Unlike traditional pet insurance that primarily focuses on unexpected illnesses or accidents, a wellness plan is tailored to cover routine check-ups, vaccinations, dental cleanings, and even heartworm tests. Essentially, it serves as a proactive measure, ensuring that your pet receives regular preventative care, which can potentially circumvent more serious health issues down the line. For many pet owners, the appeal of a wellness plan lies in its ability to provide peace of mind. Knowing that a portion of routine veterinary costs are covered allows owners to focus less on the financial aspect and more on their pet's health. However, as with any financial commitment, it is crucial to weigh the costs against the benefits.

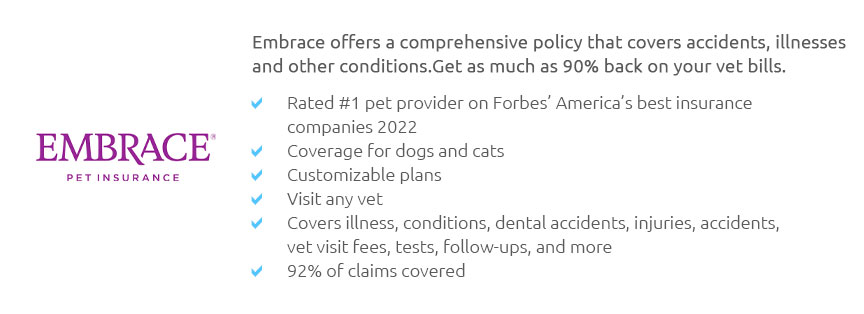

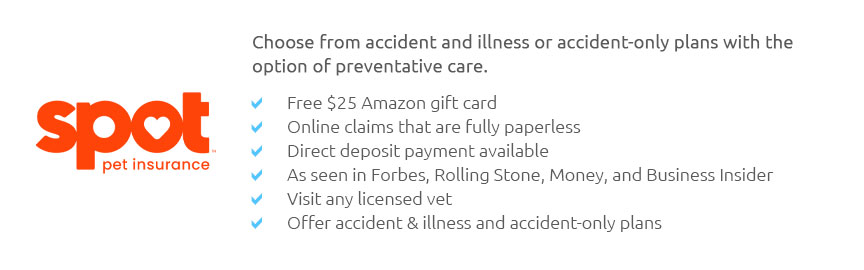

Another consideration is whether the plan's benefits outweigh its costs. For instance, if your pet rarely requires more than a yearly check-up, you might find that paying out of pocket is more economical. Conversely, if your pet has ongoing preventative needs, a wellness plan might be a cost-effective solution. Furthermore, not all insurance providers offer wellness plans, and those that do often have varying levels of coverage. It is advisable to conduct thorough research, comparing different plans and providers. Look for reviews from other pet owners, and don't hesitate to reach out to veterinary professionals for their insights. They can provide invaluable advice based on your pet's unique needs. In conclusion, while a pet insurance wellness plan is not a one-size-fits-all solution, it can be an advantageous option for those looking to ensure consistent, preventative care for their pets. It serves as a testament to the increasing recognition of pets as family members, deserving of the same level of care and attention. For any pet owner contemplating this investment, a careful evaluation of your pet's needs and your financial situation is crucial. Ultimately, the goal is to enhance the quality of life for your beloved companion, ensuring they remain healthy, happy, and by your side for years to come. https://www.banfield.com/products/optimum-wellness-plan

Your pet's OWP helps make petcare easier. With insurance, you pay a premium and hope your pet's services are reimbursed. With an OWP, you pay in monthly or ... https://getodie.com/wellness-plans/

Odie's wellness plan provides coverage to help offset the costs of everyday pet care items such as check-ups, flea and tick medications, vaccinations, ... https://thevets.com/resources/pet-health-care/pet-wellness-plan-guide/

A pet wellness plan is a type of preventative care insurance that encompasses routine healthcare services for pets.

|